Empirics Applications in Wealth Management Firm

Planning & Valuation

All wealth managers compete within their respective markets for retail investor assets. To date, objectively representing a firm’s position within its market and the value of its market potential in a business valuation has been constrained by a lack of analytical tools. While there’s no shortage of financial and operational data, comparables, ratios, and benchmarks, the AUM source – the firm’s retail investor market – has received a more subjective treatment in business planning and valuation.

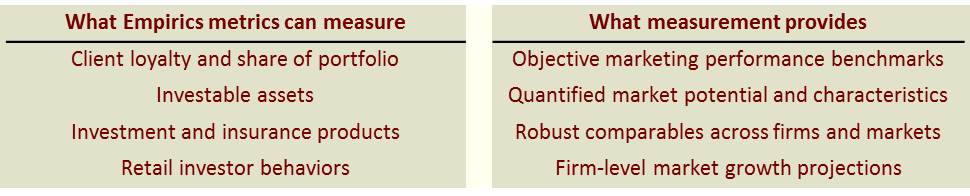

Information Asset Partners’ Empirics metrics make it possible to extend analytical rigor to the assessment of wealth management firms' market position and potential to the practice level:

Information Asset Partners’ Empirics metrics make it possible to extend analytical rigor to the assessment of wealth management firms' market position and potential to the practice level:

With design rooted in the Federal Reserve Survey of Consumer Finances, Empirics measures retail investor attributes and behaviors consistently and objectively where they are relevant – in the specific market where the wealth management practice was built and where its growth potential is based.The value of this firm and market intelligence depends on your perspective:

|

Succession planning

Selling a practice Practice acquisitions Pricing Business planning |

Assess current position and prepare the firm for valuation and transition

Quantify market performance and market potential that supports valuation and a transition that preserves value for the buyer Broader search scope and more comprehensive evaluations produce improved fit and post-transaction performance An objective assessment of a practice's unique retail market characteristics and growth rate supports service pricing decisions Objective market position assessment and improved quantification of marketing program alternatives to achieve growth |

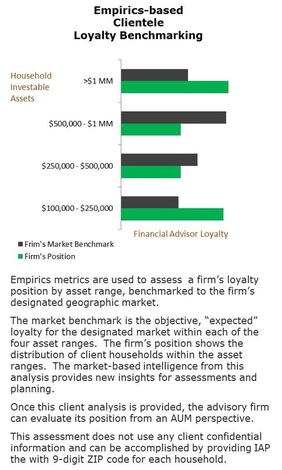

Below are examples (click on graphic to enlarge) of how the metrics provide market-based intelligence that support each of these needs:

Beginning an Empirics-based Market Assessment or Benchmarking

To assist you with your firm’s valuation, business planning, or acquisition program, IAP needs to understand your marketing and business objectives. To get started, all we'll need is your geographic market designation (e.g., state, counties, ZIP codes) and a spreadsheet with client ZIP codes if you want to conduct benchmarking.

It is also possible to integrate additional data within the Empirics-based approach that is relevant to assessing and projecting a wealth management firm's market and developing comparables:

Clientele Pricing Competition Products Businesses Proprietary data

Assessments are scalable to your needs and do not involve any client privacy-sensitive information. You’ll receive personal and confidential assistance along with the analysis. Most assessments take 2-3 weeks to deliver. We can also collaborate with any consulting firm or party that you designate. Contact IAP to schedule an initial conversation.

To assist you with your firm’s valuation, business planning, or acquisition program, IAP needs to understand your marketing and business objectives. To get started, all we'll need is your geographic market designation (e.g., state, counties, ZIP codes) and a spreadsheet with client ZIP codes if you want to conduct benchmarking.

It is also possible to integrate additional data within the Empirics-based approach that is relevant to assessing and projecting a wealth management firm's market and developing comparables:

Clientele Pricing Competition Products Businesses Proprietary data

Assessments are scalable to your needs and do not involve any client privacy-sensitive information. You’ll receive personal and confidential assistance along with the analysis. Most assessments take 2-3 weeks to deliver. We can also collaborate with any consulting firm or party that you designate. Contact IAP to schedule an initial conversation.