Market outlook:

Marketing wealth management to single women in metro New York City

Single women-headed family households with investable assets >$100,000 segment in metro New York:

Up trend New York advisors experience increasing affinity for their

through 2015 services within this segment

Down trend This market is large, declining in urban counties,

through 2015 and growing primarily outside NYC

IAP used Empirics Perspective to evaluate and project the New York metro area's single women-headed households, their investable assets, and affinity for using financial advisors. About 40% of these heads of household are under age 55. Here are the highlights:

Up trend New York advisors experience increasing affinity for their

through 2015 services within this segment

Down trend This market is large, declining in urban counties,

through 2015 and growing primarily outside NYC

IAP used Empirics Perspective to evaluate and project the New York metro area's single women-headed households, their investable assets, and affinity for using financial advisors. About 40% of these heads of household are under age 55. Here are the highlights:

|

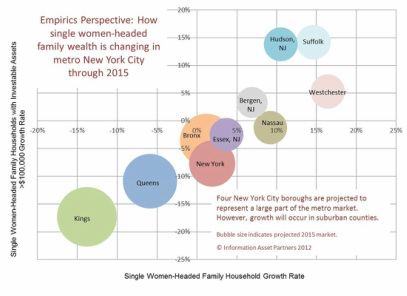

Metro NYC single women-headed households with investable assets >$100,000 are trending

down through 2015 Family households headed by unmarried women with investable assets >$100,000 are projected to increase on a national basis through 2015, making them an attractive segment for financial services marketers. The New York metro will remain the largest market for this segment through 2015 despite a projected decline. Growth in suburban New York and New Jersey counties will partially offset declines in the large NYC boroughs, Kings, Bronx, New York, and Queens. |

|

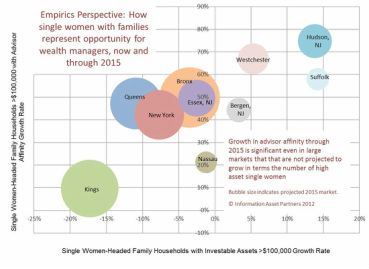

Metro NYC advisors can expect

increasing affinity for their services across the metro market Wealth managers should expect to attract more assets within the single women-headed households having investable assets over >$100,000. As measured by Empirics’ financial advisor affinity metric, metro New York’s current market is projected to increase significantly through 2015. Notably, only Kings and Nassau counties lag among the major counties. Even counties that are expected to decline in terms of segment households with assets show projected growth over 30%. |